The Bureau of Internal Revenue (BIR) has instructed the online sellers and other electronic-trading businesses to record their past operations, declare previous activities, and liquidate their corresponding taxes before the end of July to guarantee tax compliance and for taxation purposes.

This is the government’s effort to raise more funds as the Philippines is suffering from an economic downturn since the novel coronavirus occurred.

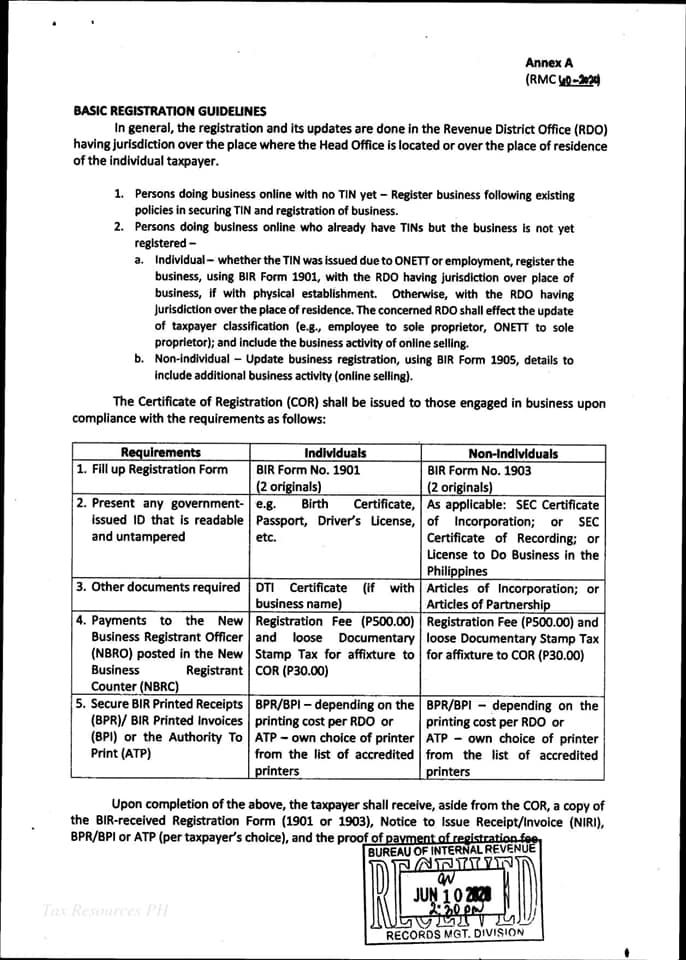

According to the agency’s Memorandum Circular No. 60-2020, those who make money in any manner specifically on digital platforms should ensure that they are registered pursuant to the provisions of Section 236 tax code, as amended, that they are tax compliant.

The memo also covers not only merchants or partner sellers but also stakeholders like internet service providers, delivery channels, payment gateways, and other facilitators. BIR Commissioner Billy Dulay then encourages digital businessmen to update their documents and reveal their negotiations with customers to avoid the hefty penalty.

Newly registered businesses including current registrants are directed to fulfill the following:

- Official receipt of every service to buyers or Registered Sales Invoice.

- Possession of Registered Book of Accounts or other accounting records of business deals.

- Withholding of Taxes

- Filled Required Tax Returns

- On-time Payments of Correct Taxes

When the community quarantine was implemented in the country due to the COVID-19 pandemic, the workforce in physical shops were forced to shut down and movements were restricted as a precautionary measure by the Inter-Agency Task Force on Emerging Infectious Diseases (IATF). Right now, many Filipinos settled on having occupation via the internet as their source of income.

Some of them have home-based jobs while others are selling various things such as bags, clothes, perfumes, etc. Unlike in regular selling, an online salesperson needs a little capital, stable internet connection, a mobile gadget, and lots of patience and time.

Related: LTO now opens online car and license registration

Anyone can sell online as long as he/she is ready to face the challenges that may come. However, when the state-run agency announced this new procedure, online traders express their disappointment by stating that E-business is their only way to survive the health crisis and this is what they got in return.

Senator Risa Hontiveros also released a statement by saying that BIR should’ve charge Philippine Offshore Gaming Operator (POGO) their unpaid taxes worth Php 50 billion.

Earlier this week, House Ways and Means Committee Chair Joey Salceda filed a measure to charge digital services specifically on music and video streaming applications and ads on several social media platforms.